Capital Gains Tax Strategies: The Complete Guide to Deferring, Reducing, and Eliminating Investment Taxes

What the Wealthy Actually Do With Their Gains — And How You Can Use the Same Playbook

The $847,000 Question

A client came to me last year with a problem. A good problem, but still a problem.

He'd bought Amazon stock in 2008 during the financial crisis — $50,000 worth at about $40 per share. By 2024, that position was worth nearly $2.4 million.

He wanted to sell. The stock had become 60% of his portfolio. His financial advisor was having heart palpitations about concentration risk. His wife wanted to diversify. He agreed with everyone.

But here was the math:

- Gain: ~$2,350,000

- Federal long-term capital gains rate: 20%

- Net Investment Income Tax (NIIT): 3.8%

- California state tax: 13.3%

- Total tax bill: Approximately $847,000

Eight hundred forty-seven thousand dollars. Gone. Immediately. To sell a position he knew he should sell.

So he didn't sell. He stayed concentrated. He stayed anxious. And he paid his advisor to tell him things he already knew but couldn't act on.

This is the capital gains trap. The tax code creates friction that prevents rational financial decisions. You know you should diversify, rebalance, or reallocate — but the tax hit makes the math feel impossible.

Here's what most people don't realize: the tax code also provides the escape routes.

The same government that charges 23.8% (or more) on your gains has created legal mechanisms to defer, reduce, or even eliminate those taxes entirely. They're not loopholes. They're incentives — written into law to encourage specific behaviors Congress wanted to promote.

This guide explains those mechanisms: what they are, how they work, who they're for, and how to use them strategically.

"Capital gains taxes are voluntary in ways most people don't realize. Not because they're optional — you owe what you owe. But because the timing, structure, and vehicle of your investments determine how much you actually pay. The wealthy figured this out decades ago. It's time everyone else caught up."

— Kenton Gray, Founder & CEO, Veracor Group

Understanding Capital Gains: The Basics

Before we get to strategies, let's make sure we're speaking the same language.

What Is a Capital Gain?

A capital gain is profit from selling a capital asset for more than you paid for it.

Capital assets include:

- Stocks and bonds

- Real estate

- Business interests

- Cryptocurrency

- Collectibles (art, coins, etc.)

- Pretty much anything you own that's not inventory

The formula: Sale Price − Cost Basis = Capital Gain (or Loss)

Cost basis is what you paid for the asset, plus certain adjustments (commissions, improvements for real estate, etc.).

Short-Term vs. Long-Term

The tax code treats gains differently based on how long you held the asset:

Short-term gains (held ≤ 1 year): Taxed as ordinary income. Top federal rate: 37%.

Long-term gains (held > 1 year): Preferential rates. Top federal rate: 20%.

This single distinction — one year and one day — can mean a 17 percentage point difference in your tax rate. The most basic capital gains strategy is simply: hold longer than a year whenever possible.

Current Federal Tax Rates (2024-2025)

Long-term capital gains rates:

| Taxable Income (Single) | Taxable Income (Married) | Rate |

|---|---|---|

| Up to $47,025 | Up to $94,050 | 0% |

| $47,026 - $518,900 | $94,051 - $583,750 | 15% |

| Over $518,900 | Over $583,750 | 20% |

Don't forget the extras:

- Net Investment Income Tax (NIIT): Additional 3.8% on investment income for individuals earning over $200,000 ($250,000 married)

- State taxes: Range from 0% (Texas, Florida, etc.) to 13.3% (California)

For a high earner in California, the combined rate on long-term gains can exceed 37%. Short-term gains can approach 50%.

These aren't hypotheticals. These are real rates that real people pay.

"People obsess over investment returns while ignoring tax efficiency. A 10% return taxed at 40% is a 6% return. A 10% return taxed at 15% is an 8.5% return. Over 20 years, that difference is enormous. Tax strategy isn't optional — it's half the game."

— Kenton Gray

Strategy 1: Tax-Loss Harvesting

What It Is

Tax-loss harvesting means selling investments at a loss to offset gains, reducing your tax bill.

How It Works

- You have a $100,000 gain from selling Stock A

- You also own Stock B, which is down $30,000

- Sell Stock B, realizing the $30,000 loss

- Your net gain is now $70,000 (not $100,000)

- Tax savings at 23.8%: $7,140

The Wash Sale Rule

The IRS isn't stupid. They anticipated people would sell losers, claim the loss, then immediately buy the same investment back.

The wash sale rule: If you sell a security at a loss and buy a "substantially identical" security within 30 days (before or after), the loss is disallowed.

What's "substantially identical"?

- Same stock = identical

- Same mutual fund = identical

- Different S&P 500 index funds = probably substantially identical

- S&P 500 fund vs. Total Market fund = probably not identical (but gray area)

The workaround: Sell the loser, immediately buy something similar but not identical. After 31 days, you can switch back if you want.

Example:

- Sell Vanguard S&P 500 ETF (VOO) at a loss

- Immediately buy Schwab US Large Cap ETF (SCHX)

- Harvest the loss, maintain market exposure

- After 31 days, sell SCHX and buy VOO if preferred

When to Harvest

Year-end: December is traditional tax-loss harvesting season. Review your portfolio for positions with unrealized losses.

Throughout the year: Volatility creates opportunities. A market drop in March might offer better harvesting than December.

Continuously: Some robo-advisors and tax-managed accounts harvest automatically when opportunities arise.

What You Can Offset

Capital losses offset capital gains dollar for dollar.

Excess losses offset ordinary income up to $3,000/year.

Remaining losses carry forward indefinitely until used.

If you have $50,000 in losses but only $20,000 in gains:

- $20,000 offsets gains

- $3,000 offsets ordinary income this year

- $27,000 carries forward to future years

The Limitation

Tax-loss harvesting defers taxes more than it eliminates them. By selling the loser, you reset your cost basis. Future gains will be calculated from the lower price.

Still, deferral has value. A dollar saved today and invested is worth more than a dollar paid today.

Strategy 2: Qualified Opportunity Zone Funds

What It Is

Opportunity Zone (OZ) funds offer the most powerful capital gains benefits in the current tax code. Invest capital gains into a Qualified Opportunity Fund, and you can:

- Defer the original gain until 2026 (or until you sell the OZ investment)

- Potentially eliminate taxes on appreciation within the OZ fund (if held 10+ years)

How It Works

- You sell an asset with a $500,000 gain

- Within 180 days, you invest $500,000 in a Qualified Opportunity Fund

- You report the gain, but elect deferral — no tax due now

- The QOF invests in real estate or businesses in designated Opportunity Zones

- December 31, 2026: Deferred gain becomes taxable (regardless of whether you've sold)

- If you hold the OZ investment for 10+ years: ALL appreciation in the QOF is tax-free

The Tax Math Example

Without OZ Fund:

- $500,000 gain

- 23.8% federal tax

- Tax owed now: $119,000

With OZ Fund (10-year hold):

- $500,000 invested in QOF

- 2026: Pay tax on original $500,000 gain (~$119,000)

- But: If QOF grows to $1,000,000 over 10 years, the $500,000 appreciation is tax-free

- Tax saved on appreciation: $119,000

Net benefit: Same tax on the original gain, but potentially massive tax savings on growth.

Who It's For

- Investors with capital gains they'd otherwise pay tax on

- Long time horizons (10+ years minimum to maximize benefits)

- Comfort with illiquid investments

- Interest in real estate or operating businesses in emerging areas

The Catch

2026 is coming. The deferred gain becomes taxable December 31, 2026, whether you're ready or not. You need a plan for that tax bill.

Investment quality still matters. Tax benefits don't make a bad investment good. Underwrite the deal on its merits.

Illiquidity is real. You need a 10-year hold to maximize benefits. Can't access that money.

We've written an entire guide on this: The Complete Guide to Opportunity Zone Investing.

"Opportunity Zones are the best legal tax shelter available today for capital gains. But 'best tax shelter' doesn't mean 'risk-free investment.' The tax benefits are real. The underlying deal still needs to make sense."

— Kenton Gray

Strategy 3: 1031 Exchanges

What It Is

A 1031 exchange (named after IRC Section 1031) allows you to sell investment real estate and reinvest in new investment real estate while deferring all capital gains taxes.

How It Works

- Sell investment property (the "relinquished property")

- Identify replacement property within 45 days

- Close on replacement property within 180 days

- All proceeds must go into the new property

- Capital gains tax: $0 (for now)

The Rules

Like-kind property: Real estate for real estate. Doesn't have to be the same type (you can exchange an apartment building for a shopping center).

Investment or business use: Your personal residence doesn't qualify. Must be held for investment or business.

Equal or greater value: To defer all gains, the replacement property must be equal or greater in value, and you must reinvest all the equity.

Qualified intermediary required: You can't touch the money. It must go through a QI who holds funds between transactions.

Strict timelines:

- 45 days to identify replacement properties (up to 3, or more under certain rules)

- 180 days to close

Miss these deadlines by even one day, and the exchange fails.

The Tax Math Example

Without 1031:

- Sell property for $2,000,000

- Original cost basis: $800,000

- Gain: $1,200,000

- Tax at 23.8%: $285,600

- Cash to reinvest: ~$1,714,400

With 1031:

- Sell property for $2,000,000

- Exchange into new property worth $2,000,000+

- Tax: $0

- Equity in new property: Full $1,200,000 (plus your original basis)

You just kept $285,600 working for you instead of sending it to the IRS.

Defer Forever?

Some investors 1031 exchange throughout their lives, deferring gains indefinitely. At death, heirs receive a stepped-up basis — the property's value resets to fair market value at death.

The result: Gains deferred during life can be eliminated entirely through the step-up.

This is how real estate dynasties are built.

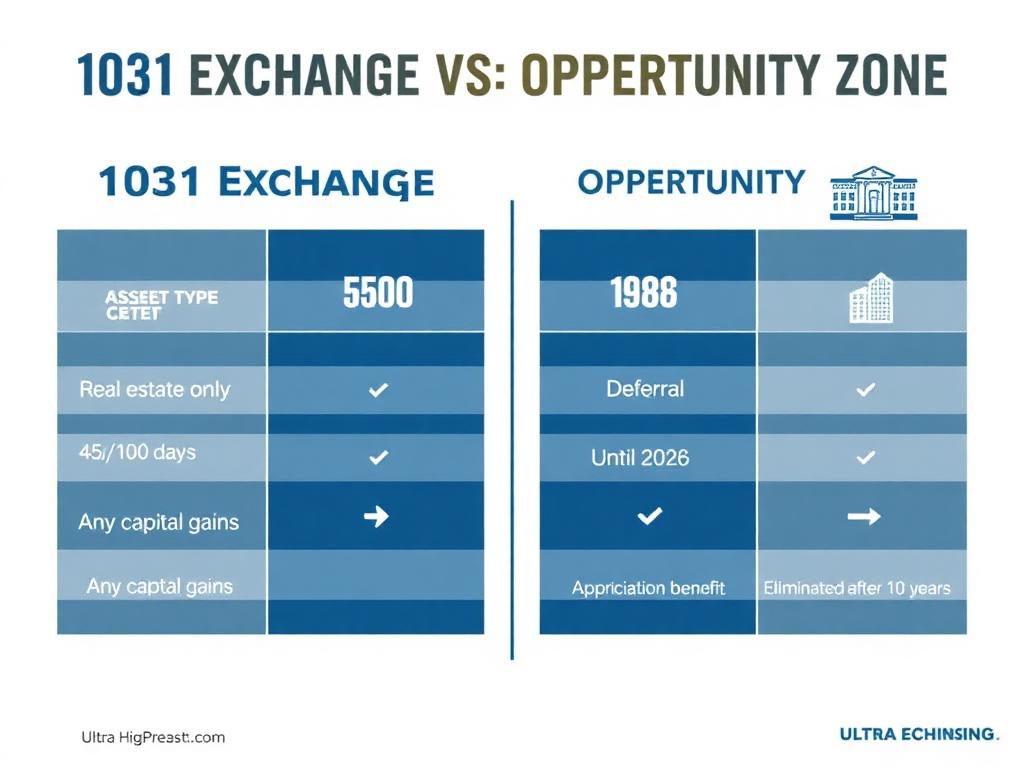

1031 vs. Opportunity Zones

| Factor | 1031 Exchange | Opportunity Zone |

|---|---|---|

| Asset type | Real estate only | Real estate or businesses |

| Gains that qualify | Real estate gains only | Any capital gains |

| Timeline | 45/180 day rules | 180 days to invest |

| Deferral | Indefinite (until sale) | Until 2026 |

| Appreciation benefit | Deferred (not eliminated) | Eliminated after 10 years |

| Complexity | Moderate | High |

When to use 1031: Real estate gains, want indefinite deferral, don't need the appreciation elimination.

When to use OZ: Non-real estate gains, want appreciation elimination, willing to commit 10+ years.

Strategy 4: Installment Sales

What It Is

Instead of receiving full payment at sale, you receive payments over time. Taxes are spread out accordingly.

How It Works

- Sell an asset for $1,000,000

- Receive $200,000 down, $200,000/year for 4 more years

- Report gain proportionally as payments are received

- Each payment includes return of basis + gain + interest

Why It Matters

Lower brackets: Spreading gains over multiple years might keep you in lower tax brackets.

Defer the tax: Money not sent to the IRS today can be invested.

Seller financing premium: Buyers often pay more for seller financing, offsetting deferred tax benefits.

Example

Asset sold for $1,000,000 with $400,000 cost basis = $600,000 gain (60% of sale price).

Lump sum sale:

- $600,000 gain in Year 1

- Potentially pushes into highest brackets

- Full tax owed immediately

Installment sale ($200,000/year for 5 years):

- Each payment: $120,000 gain (60% of $200,000)

- Gains spread over 5 years

- May stay in lower brackets

- Tax deferred on future payments

Best For

- Selling a business or large asset to a buyer who needs financing

- Situations where lump-sum payment would spike you into higher brackets

- Sellers comfortable with buyer credit risk

Strategy 5: Charitable Strategies

Donor-Advised Funds (DAFs)

What it is: Contribute appreciated assets to a DAF, get an immediate tax deduction, avoid capital gains entirely, and distribute to charities over time.

How it works:

- Transfer $100,000 of stock (cost basis: $20,000) to DAF

- Deduction: $100,000 (fair market value)

- Capital gains tax avoided: $19,040 (23.8% of $80,000 gain)

- Funds grow tax-free in DAF

- Grant to charities whenever you choose

The math: You avoid capital gains AND get a deduction. Double benefit.

Best for: Investors who want to give to charity anyway. Instead of selling stock, paying tax, and donating cash — donate the stock directly.

Charitable Remainder Trusts (CRTs)

What it is: Transfer appreciated assets to an irrevocable trust, receive income stream for life (or a term), remainder goes to charity.

How it works:

- Transfer $1,000,000 of appreciated stock to CRT

- Trust sells stock — no immediate capital gains (trust is tax-exempt)

- Trust invests proceeds

- You receive income stream (e.g., 5% annually for life)

- At death/term end, remainder goes to charity

- You receive partial charitable deduction upfront

Best for: Investors with highly appreciated assets who want income, charitable intentions, and tax efficiency.

Complexity warning: CRTs require legal setup, ongoing administration, and irrevocable commitment. Not for casual use.

Qualified Charitable Distributions (QCDs)

What it is: If you're 70½+, donate up to $100,000 directly from your IRA to charity. The distribution satisfies RMDs but isn't taxable income.

Note: This is income tax strategy, not capital gains specifically, but relevant for overall tax planning.

Strategy 6: Holding Period Optimization

Sometimes the simplest strategies are the most powerful.

The One-Year Line

Hold an asset for one year and one day, and your federal rate drops from up to 37% to a maximum of 20% (plus NIIT).

The math on a $100,000 gain:

- Short-term (37% + 3.8%): $40,800 tax

- Long-term (20% + 3.8%): $23,800 tax

- Savings: $17,000

If you're thinking of selling in month 11, wait until month 13 unless there's a compelling reason not to.

Lot Selection

If you've purchased shares at different times, you can often choose which lots to sell (specific identification method).

Example:

- Bought 100 shares at $50 in 2020

- Bought 100 shares at $150 in 2023

- Current price: $200

Sell the 2023 shares: $50/share gain × 100 = $5,000 gain

Sell the 2020 shares: $150/share gain × 100 = $15,000 gain

Same number of shares sold. Very different tax outcomes.

Work with your broker to ensure specific lot identification is properly documented.

Strategy 7: Qualified Small Business Stock (QSBS)

What It Is

If you hold stock in a qualified small business for 5+ years, you can exclude up to $10 million (or 10x your basis, whichever is greater) in gains from federal tax.

Requirements

Qualified small business:

- C corporation

- Gross assets ≤ $50 million at issuance and immediately after

- Active business (not holding companies, financial services, etc.)

- Stock acquired at original issuance

Holding period: 5+ years

Exclusion: 100% for stock acquired after September 27, 2010

The Impact

Sell $10 million of QSBS that qualifies: $0 federal tax on the gain.

This is the most generous capital gains exclusion in the tax code. It's why startup founders and early employees can sometimes realize enormous gains tax-free.

Planning Opportunities

Gift to family members: Each person gets their own $10 million exclusion. Gifting shares before sale multiplies the benefit.

State taxes vary: Some states don't conform to federal QSBS treatment. California, for example, doesn't allow the exclusion.

Documentation matters: Keep meticulous records proving qualification.

Strategy 8: Step-Up in Basis at Death

What It Is

When you die, your heirs receive assets with a cost basis "stepped up" to fair market value at death. All unrealized gains disappear.

How It Works

- You bought stock for $100,000

- It's now worth $1,000,000

- Unrealized gain: $900,000

- If you sell: Tax on $900,000

- If you die and heirs inherit: Their basis is $1,000,000

- If heirs sell immediately: $0 gain, $0 tax

$214,200 in taxes (at 23.8%) simply... vanishes.

The Strategy

Some investors deliberately hold highly appreciated assets until death, never selling. They live off other income/assets, bequeath the appreciated positions, and eliminate the gains entirely.

This works best for:

- Very long time horizons

- Assets you don't need to sell

- Estate planning that accounts for this strategy

The Risk

Tax laws can change. Step-up in basis has been targeted for elimination or modification multiple times. There's no guarantee it will exist when you die.

Concentration risk: Holding one position forever creates portfolio risk.

You're dead: You don't get to enjoy the savings personally.

Combining Strategies: The Real-World Approach

Smart capital gains planning usually involves multiple strategies working together.

Example: The Business Owner Exit

Situation: Founder selling business for $5 million. Cost basis: $200,000. Gain: $4.8 million.

Naive approach: Sell, pay ~$1.14 million in federal taxes.

Strategic approach:

-

Charitable giving: Donate 10% ($500,000) of stock to DAF before sale

- Avoid tax on $480,000 gain

- Get $500,000 charitable deduction

- Tax savings: ~$200,000

-

QSBS exclusion: If stock qualifies, exclude up to $10 million

- Potentially eliminates entire federal tax

- Check state treatment

-

Opportunity Zone: Invest $1,000,000 of proceeds in QOF

- Defer $1M of gain

- Eliminate tax on QOF appreciation after 10 years

-

Installment sale: Structure portion as seller financing

- Spread gains over multiple years

- Stay in lower brackets

-

Estate planning: Hold remaining shares for step-up potential

Result: Tax bill potentially reduced from $1.14 million to a fraction of that — or possibly near zero if QSBS applies.

This is what wealthy people do. It's not evasion. It's planning.

What NOT to Do

Don't Let Tax Tail Wag Investment Dog

Taxes matter. But they're not the only thing that matters.

Holding a concentrated position to avoid taxes is dangerous if that position collapses. Ask anyone who held Enron stock for "tax efficiency."

Rule of thumb: If the investment case has changed, don't let taxes prevent a rational decision. Pay the tax, move on, sleep better.

Don't Get Too Clever

Aggressive tax strategies attract IRS attention. If something sounds too good to be true, it probably is.

Stick to well-established strategies with clear legal footing. Economic substance matters — transactions structured only for tax benefits, with no real economic purpose, can be challenged.

Don't DIY Complex Strategies

Tax-loss harvesting? You can probably handle that.

Setting up a charitable remainder trust to fund an opportunity zone investment through an installment sale? You need professionals.

A good tax attorney and CPA will cost money upfront but save multiples of that in correctly executed strategies.

Don't Forget State Taxes

Federal strategies are great. But if you live in California, New York, or New Jersey, state taxes might be 10-13% on top.

Some strategies (like QSBS) don't work at the state level. Others (like moving to Florida) are more drastic but increasingly common.

The Veracor Approach to Tax-Efficient Investing

Tax efficiency is embedded in how we structure investments.

Opportunity Zone Focus

Our OZ Fund offers the most powerful tax benefits available for capital gains. Investors defer current gains and potentially eliminate taxes on appreciation.

Long-Term Structures

Our patient capital approach naturally aligns with favorable tax treatment. We're not flipping — we're building. Long hold periods mean long-term capital gains rates.

Pass-Through Benefits

Our real estate investments pass through depreciation and other deductions, potentially offsetting income from other sources.

Tax-Aware Planning

We work with investors to understand their tax situations and position investments accordingly. The same opportunity might fit differently depending on your overall picture.

Action Steps

Immediate

- Know your gains. Review your portfolio for unrealized gains and their holding periods.

- Harvest losses. Year-end is approaching — identify loss harvesting opportunities.

- Check holding periods. Anything close to one year? Wait for long-term treatment.

Near-Term

- Evaluate Opportunity Zones if you have (or expect) significant gains.

- Consider charitable strategies if giving is already part of your plan.

- Talk to professionals before any major liquidity event.

Ongoing

- Build tax efficiency into investment selection — not as an afterthought.

- Document everything — basis, holding periods, lot selection.

- Stay informed — tax laws change, and strategies that work today may change tomorrow.

Frequently Asked Questions

Q: Can I avoid capital gains taxes entirely?

In some cases, yes. QSBS exclusion, step-up in basis at death, and OZ appreciation after 10 years can all result in zero tax on specific gains. But most situations involve deferral and reduction, not elimination.

Q: What's the best capital gains strategy?

Depends on your situation. OZ funds are powerful for long-term investors. 1031 exchanges are ideal for real estate investors. QSBS is a game-changer for startup equity. There's no universal "best."

Q: Should I move to avoid state taxes?

It's a personal decision. Some people save hundreds of thousands by moving from California to Texas or Florida. Others value where they live more than the savings. Don't move just for taxes — but don't ignore the math either.

Q: Do I need a professional?

For basic strategies (loss harvesting, lot selection), maybe not. For anything involving trusts, business structures, or significant complexity — absolutely yes.

Q: How do I know if my stock qualifies for QSBS?

The company should be able to confirm. Key requirements: C corporation, under $50 million in assets at issuance, active business, stock acquired at original issuance. When in doubt, consult a tax attorney.

The Bottom Line

The tax code is full of landmines. It's also full of escape routes.

The difference between investors who pay top rates and investors who pay far less isn't evasion — it's planning. Understanding the rules. Using legal mechanisms. Thinking ahead.

The wealthy have known this for generations. They have advisors who structure every transaction for tax efficiency. They use OZ funds, 1031 exchanges, charitable strategies, and QSBS exclusions as naturally as you use a checking account.

You don't need a family office to do the same. You need knowledge, professional guidance for complex situations, and the discipline to plan before you act.

The time to plan is before you have the gain. Not after.

"The best time to think about capital gains taxes is before you have the gain. The second-best time is now. The worst time is April 14th. Most investors plan backwards — they make decisions, then figure out the tax implications. Flip that order and everything changes."

— Kenton Gray, Founder & CEO, Veracor Group

Important Disclosures

This guide is for informational and educational purposes only and does not constitute tax, legal, or investment advice. Tax laws are complex and subject to change.

Consult qualified tax and legal professionals before implementing any strategy. Individual circumstances vary significantly.

Opportunity Zone investments, 1031 exchanges, charitable strategies, and other techniques described have specific requirements, limitations, and risks not fully detailed in this overview.

© 2026 Veracor Group. All rights reserved.

Last updated: January 2026