How Regular Investors Access Apartment Buildings, Shopping Centers, and Development Deals — Without Becoming a Landlord

The 3 AM Phone Call I Never Got

In 2019, I invested $75,000 in a 284-unit apartment complex in Phoenix.

I've never seen the building in person. I don't know the name of the on-site property manager. I couldn't tell you the exact street address without looking it up.

And in four years, I've never gotten a 3 AM call about a burst pipe, a problem tenant, or a broken HVAC unit.

What I did get: quarterly distributions averaging 7.2% annually, monthly investor updates, and a K-1 every spring. When the property sold in 2023, my share of the proceeds represented a 19.4% annualized return.

No tenants. No toilets. No trash. Just checks.

This is real estate syndication — the way sophisticated investors have accessed commercial real estate for decades. Pool your capital with other investors, let a professional sponsor handle everything, and participate in deals you could never access alone.

It's not magic. It's structure. And once you understand how it works, you'll wonder why anyone would want to be a landlord the old-fashioned way.

"Real estate syndication lets you own apartment buildings the same way you own Apple stock — as a passive investor benefiting from professional management. Except the returns are often better, the tax benefits are real, and nobody's calling you at 3 AM because a toilet is broken."

— Kenton Gray, Founder & CEO, Veracor Group

What Is Real Estate Syndication?

The Simple Definition

A real estate syndication is a partnership where a sponsor (the expert) and investors (the capital) join together to buy, operate, and eventually sell a property.

Sponsor provides: Expertise, deal sourcing, management, execution.

Investors provide: Capital.

Everyone shares: Profits, according to the agreed split.

The Structure

Most syndications use a two-tier structure:

General Partner (GP): The sponsor. Makes decisions, manages the asset, takes on liability, does all the work.

Limited Partners (LP): The investors. Provide capital, receive distributions, have no operational responsibilities or liabilities beyond their investment.

As an LP, you're truly passive. You wire money, receive updates, collect checks, and eventually receive your share of sale proceeds. The GP handles everything else.

Why It Exists

Commercial real estate has a scaling problem.

A single-family rental might cost $300,000. Manageable for an individual investor.

A 200-unit apartment building might cost $30,000,000. Way beyond what most individuals can handle alone.

But that apartment building has significant advantages:

- Professional on-site management becomes economical

- Better financing terms from lenders

- Diversification (200 tenants vs. 1)

- Economies of scale on maintenance and operations

- Institutional buyer interest at exit

Syndication solves the capital gap. Pool 30-50 investors contributing $50,000-$100,000 each, and suddenly that $30 million building is accessible.

Everyone benefits from scale they couldn't achieve alone.

Why Syndications Over Other Real Estate Investments?

Let's compare your options.

Option 1: Direct Ownership (Be a Landlord)

You buy a property. You manage it (or hire a manager). You deal with everything.

Pros:

- Full control

- Keep all the profits

- Build equity directly

Cons:

- Large capital requirement for quality properties

- You're responsible for everything

- Tenant calls, maintenance, vacancies, evictions

- Concentration risk (one property, one market)

- Hard to diversify

- Active, not passive

Best for: People who want to be landlords professionally.

Option 2: REITs (Real Estate Investment Trusts)

Public companies that own real estate. Buy shares like stock.

Pros:

- Complete liquidity (sell anytime)

- No minimum investment

- Professional management

- Diversified across properties

Cons:

- Stock market correlation (defeats diversification purpose)

- No control over specific properties

- No direct tax benefits (depreciation doesn't flow through)

- REIT dividends often taxed as ordinary income

- You're buying at market prices, not wholesale

Best for: Investors wanting real estate exposure with stock-like liquidity.

Option 3: Syndications

Pool capital with other investors. Professional sponsor manages everything.

Pros:

- True passivity

- Access to institutional-quality properties

- Direct ownership benefits (depreciation, appreciation)

- Tax advantages flow through to you

- Uncorrelated with stock market

- Often better risk-adjusted returns than REITs

Cons:

- Illiquid (usually 3-7+ year holds)

- Minimum investments ($25K-$100K typically)

- Sponsor risk (you're betting on their execution)

- Requires due diligence

- Usually requires accredited investor status

Best for: Accredited investors who want real estate benefits without active involvement.

The Comparison Table

| Factor | Direct Ownership | REITs | Syndications |

|---|---|---|---|

| Control | Full | None | Limited |

| Passivity | Low | High | High |

| Liquidity | Low | High | Low |

| Minimum Investment | High | None | Medium |

| Tax Benefits | Full | Limited | Full |

| Stock Correlation | Low | High | Low |

| Diversification | DIY | Built-in | Deal-by-deal |

| Accreditation Required | No | No | Usually |

"REITs are real estate in name only — they trade like stocks, correlate with stocks, and don't give you the tax benefits of actual real estate ownership. Syndications give you real ownership in real properties with real tax advantages. The trade-off is liquidity. If you can live with that, the economics are usually better."

— Kenton Gray

How Syndications Work: A Complete Walkthrough

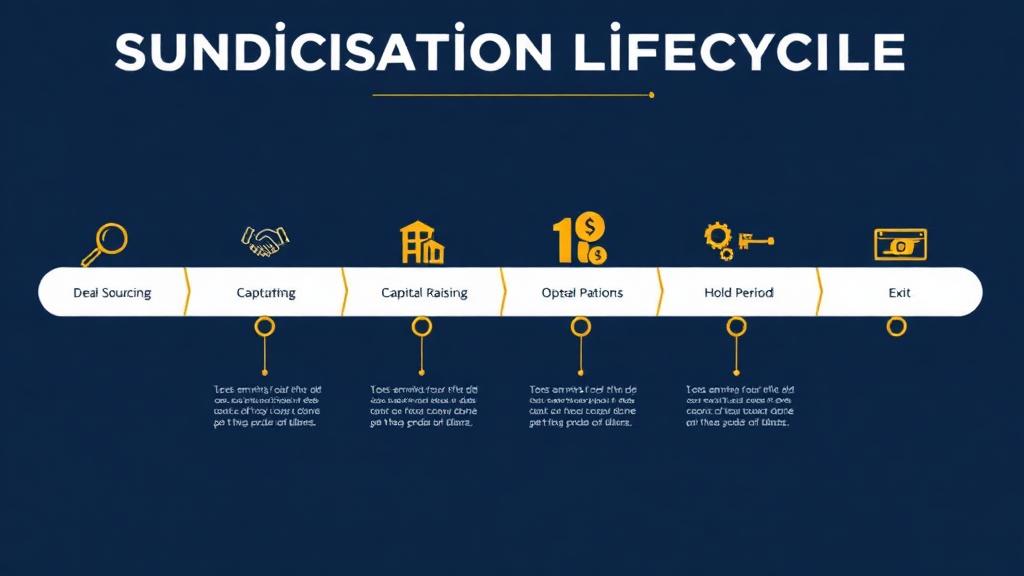

Let me trace the lifecycle of a typical syndication so you know exactly what happens with your money.

Phase 1: Deal Sourcing

The sponsor identifies an opportunity. This could be:

- Value-add: A property that's underperforming but can be improved (renovations, better management, rent increases)

- Core/Core-plus: A stable, well-performing property offering steady returns

- Development: Ground-up construction of new property

- Distressed: A troubled property bought at a discount

The sponsor analyzes the deal, negotiates terms, and puts the property under contract.

Phase 2: Capital Raising

With the property under contract, the sponsor raises capital from investors.

You receive:

- Private Placement Memorandum (PPM) — the disclosure document

- Investment summary or pitch deck

- Pro forma projections

- Sponsor track record

You evaluate:

- Does this deal make sense?

- Do I trust this sponsor?

- Does this fit my portfolio?

If you proceed:

- Sign subscription agreement

- Verify accredited status

- Wire funds

Phase 3: Closing and Acquisition

Once capital is raised, the syndication closes on the property.

What happens:

- Sponsor's entity takes title

- Bank financing is put in place (typically 60-75% leverage)

- Your capital fills the remaining equity need

- You become a limited partner in the owning entity

Phase 4: Operations (The Hold Period)

Now the sponsor executes the business plan.

For value-add deals:

- Renovate units

- Improve common areas

- Raise rents to market

- Reduce expenses

- Increase occupancy

For stabilized deals:

- Maintain high occupancy (95%+)

- Manage expenses

- Implement modest rent increases

- Preserve asset quality

What you experience:

- Monthly or quarterly updates

- Distribution checks (often quarterly)

- Annual K-1s for taxes

- Occasional investor calls

Phase 5: Exit

After the target hold period (typically 3-7 years), the sponsor sells the property.

Exit options:

- Sale to another investor or fund

- Sale to an institutional buyer (REIT, pension fund)

- Refinancing and cash-out (partial exit)

- 1031 exchange into another property

What you receive:

- Your share of sale proceeds

- Final distribution

- Final K-1

The syndication ends. You've (hopefully) made money.

Understanding the Economics

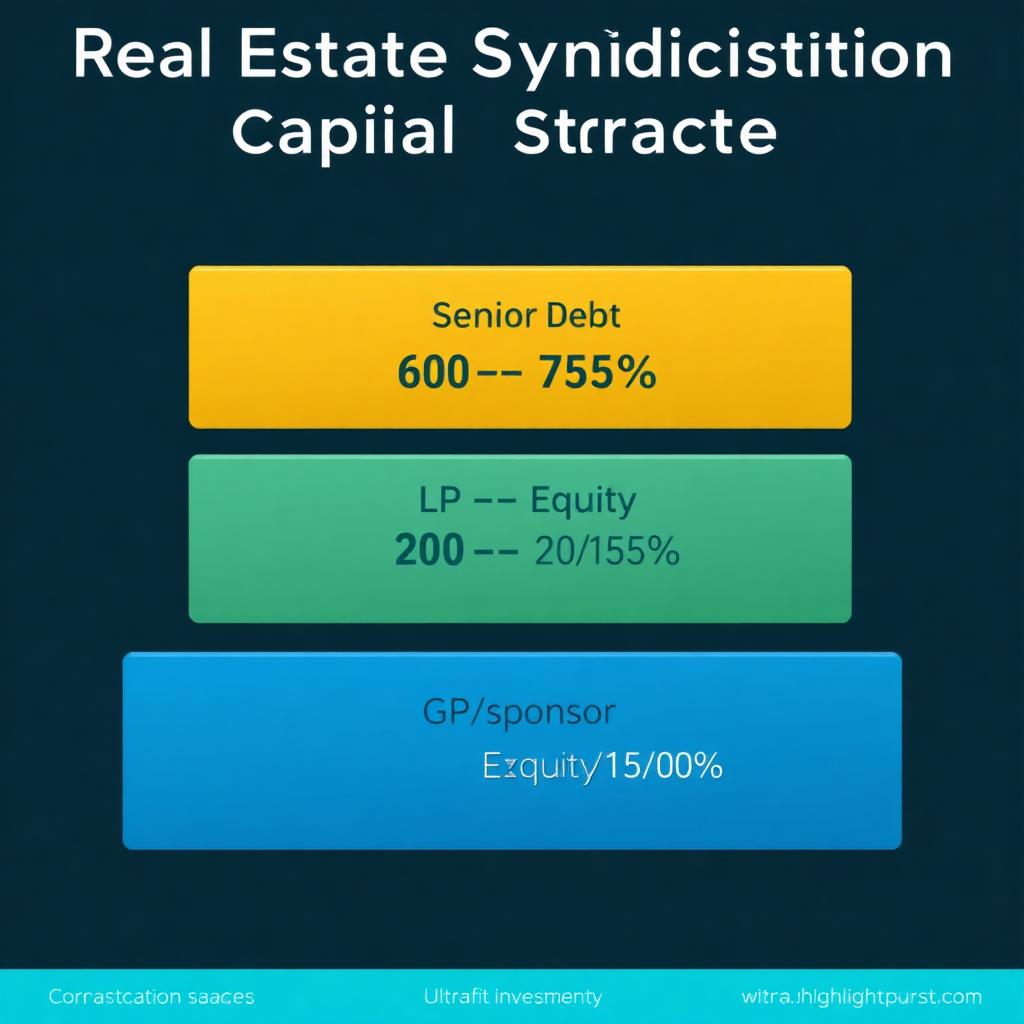

The Capital Stack

Every syndication has a capital structure — who provides what money, and who gets paid in what order.

Typical capital stack:

| Layer | Source | Typical Amount | Return/Priority |

|---|---|---|---|

| Senior Debt | Bank/Lender | 60-75% | Fixed interest, first priority |

| Equity | Investors (LP) | 20-35% | Preferred return + share of profits |

| Sponsor Equity | GP | 5-10% | Co-invest alongside LPs |

Why this matters: Senior debt gets paid first. If things go wrong, equity (you) absorbs losses first. Leverage amplifies both returns and risks.

The Waterfall

The "waterfall" describes how profits are distributed between LPs and GPs.

Typical structure:

- Return of Capital: LPs get their original investment back first

- Preferred Return: LPs receive a preferred return (often 6-8%) before GP participates

- Catch-up: GP may "catch up" to the preferred return percentage

- Profit Split: Remaining profits split between LP and GP (often 70/30 or 80/20)

Example with 8% pref and 70/30 split:

- Total project profit: $1,000,000

- LP capital: $2,000,000

- Preferred return (8%): $160,000 → LPs

- Remaining: $840,000

- LP share (70%): $588,000

- GP share (30%): $252,000

LP total: $748,000 (37.4% return on capital)

Key Metrics to Understand

Cash-on-Cash Return: Annual cash distributions ÷ capital invested.

Example: $6,000 annual distributions on $75,000 invested = 8% cash-on-cash

Internal Rate of Return (IRR): Annualized return accounting for timing of all cash flows. The true measure of overall performance.

A deal might have 6% cash-on-cash but 18% IRR if there's significant appreciation at sale.

Equity Multiple: Total distributions ÷ capital invested.

2.0x equity multiple means you doubled your money. If you invested $100K, you got back $200K total.

Average Annual Return (AAR): Simple average of returns over the hold period.

$100K invested, $200K returned over 5 years = 20% AAR (2.0x - 1 = 100% / 5 years)

What "Good" Looks Like

There's no universal standard, but rough benchmarks:

| Strategy | Target IRR | Target Cash-on-Cash | Target Multiple | Typical Hold |

|---|---|---|---|---|

| Core (low risk) | 8-12% | 4-6% | 1.3-1.6x | 7-10 years |

| Core-Plus | 10-14% | 5-7% | 1.5-1.8x | 5-7 years |

| Value-Add | 14-20% | 6-9% | 1.7-2.2x | 3-5 years |

| Development | 18-25%+ | Variable | 2.0x+ | 2-4 years |

Higher projected returns = higher risk. There's no free lunch.

Types of Syndication Strategies

Value-Add (Most Common)

What it is: Buy underperforming properties, improve them, increase income, sell at higher value.

The playbook:

- Find property with below-market rents or operational issues

- Renovate units (new kitchens, flooring, fixtures)

- Improve common areas (amenities, landscaping, curb appeal)

- Better management (reduce expenses, increase occupancy)

- Raise rents to market

- Sell to buyers paying premium for stabilized asset

Risk/Return: Moderate-to-high returns, execution risk.

What can go wrong: Renovations cost more than expected. Rent increases don't materialize. Market softens during hold period.

Core/Core-Plus

What it is: Buy stable, high-quality properties. Collect income. Modest improvements. Hold long-term.

The playbook:

- Acquire Class A or strong Class B property

- Maintain high occupancy (95%+)

- Implement annual rent increases

- Minor improvements over time

- Hold for steady income

- Sell when market is favorable

Risk/Return: Lower returns, lower risk.

What can go wrong: Market rents decline. Major capital expenses arise. Interest rates rise significantly on refinancing.

Development

What it is: Build new properties from the ground up.

The playbook:

- Acquire land

- Entitle and permit

- Construct building

- Lease up

- Sell or hold

Risk/Return: Highest potential returns, highest risk.

What can go wrong: Construction delays and cost overruns. Lease-up takes longer than expected. Market shifts during construction.

Distressed/Opportunistic

What it is: Buy troubled assets at deep discounts, turn them around.

Examples:

- Properties in foreclosure

- Assets from motivated sellers

- Mismanaged properties

- Markets recovering from downturns

Risk/Return: Very high potential returns, significant execution risk.

Property Types in Syndications

Multifamily (Apartments)

The workhorse of syndication. Most syndications are apartment buildings.

Why:

- Consistent demand (everyone needs housing)

- Multiple tenants diversify income

- Easier to finance

- Clear value-add playbooks exist

- Strong institutional buyer interest

What to look for: Growing markets, employment diversity, population inflows, supply constraints.

Industrial

Warehouses, distribution centers, manufacturing facilities.

Tailwinds: E-commerce growth, supply chain reshoring, last-mile delivery needs.

Considerations: Tenant concentration risk, specialized buildings may have limited alternative uses.

Retail

Shopping centers, strip malls, single-tenant retail.

Challenges: E-commerce disruption, changing consumer habits.

Opportunities: Grocery-anchored centers, service-oriented retail, experiential retail.

Office

Suburban and urban office buildings.

Challenges: Remote work impact, oversupply in many markets.

Considerations: Flight to quality (Class A benefits, Class B/C struggles).

Self-Storage

Storage unit facilities.

Appeal: Recession-resistant, fragmented market, operational simplicity.

Considerations: Increasingly competitive, development risk.

Medical/Healthcare

Medical office buildings, senior housing, specialty facilities.

Tailwinds: Aging demographics, healthcare spending growth.

Considerations: Specialized tenants, regulatory factors.

"I'm biased toward multifamily. Everyone needs a place to live. Apartments have multiple tenants, so one vacancy doesn't tank your income. The financing markets are deep. The value-add playbook is well-established. It's not the only option, but it's a great place to start."

— Kenton Gray

Evaluating Sponsors: The Most Important Due Diligence

The sponsor makes or breaks your investment. A great sponsor can navigate challenges. A poor sponsor can ruin a good deal.

Track Record

What to examine:

- Realized deals: Not projected — actually completed investments

- Number of deals: Enough to demonstrate consistency

- Performance vs. projections: Did they hit their targets?

- Full-cycle experience: Have they bought, operated, AND sold?

- Market conditions: Did they succeed in good times and bad?

Red flags:

- Only showing winners

- No full-cycle experience (only acquisitions, no exits)

- Projected returns on unrealized investments presented as track record

Alignment

Co-investment: How much of the sponsor's own money is in the deal?

A sponsor with meaningful co-investment feels the same pain you do if things go wrong. "Meaningful" means significant relative to their net worth, not just a token amount.

Fee structure: Are fees reasonable and aligned with performance?

Standard fees:

- Acquisition fee: 1-2% of purchase price

- Asset management fee: 1-2% of equity or revenue annually

- Disposition fee: 1% of sale price

- Promoted interest: 20-30% of profits above preferred return

Excessive fees or fees that don't depend on performance are red flags.

Team and Infrastructure

- Who are the key people, and how long have they worked together?

- Do they have the bandwidth for this deal?

- What happens if a key person leaves?

- Do they have proper systems, reporting, and compliance?

Communication

- How do they communicate with investors?

- How often?

- How transparent are they when things go wrong?

Ask for references. Call existing investors. Ask specifically about communication, especially during challenges.

Red Flags

| Warning Sign | What It Means |

|---|---|

| No co-investment | Misaligned incentives |

| Projected returns only | No actual track record |

| Pressure to invest quickly | Legitimate deals allow due diligence time |

| Can't explain the business plan clearly | Don't understand their own deal |

| Excessive fees | Sponsors optimizing for themselves |

| Poor communication history | Won't improve with your money |

| Key person concentration | Succession risk |

Understanding the Risks

Syndications can lose money. Let's be clear about how.

Market Risk

Real estate markets are cyclical. What goes up can go down.

How it hurts: Property values decline, rents soften, exits become difficult or unprofitable.

Mitigation: Diversify across markets and vintages. Don't assume current conditions last forever.

Execution Risk

The sponsor might not execute the business plan successfully.

How it hurts: Renovations cost more than expected. Rent increases don't materialize. Occupancy stays low.

Mitigation: Sponsor track record, conservative underwriting, sufficient reserves.

Financing Risk

Debt is a double-edged sword.

How it hurts: Interest rates rise on floating-rate debt. Refinancing becomes expensive or unavailable. Loan maturities force sales at bad times.

Mitigation: Fixed-rate debt when possible, conservative leverage, long-term loans.

Sponsor Risk

The sponsor could be incompetent, fraudulent, or simply overwhelmed.

How it hurts: Poor decisions, mismanagement, malfeasance.

Mitigation: Due diligence on sponsor, references, track record verification.

Illiquidity Risk

You can't sell when you want.

How it hurts: Life happens — you need the money, but it's locked up.

Mitigation: Only invest money you genuinely don't need for the full hold period.

Concentration Risk

Too much in one deal, one sponsor, or one market.

How it hurts: If that one thing goes wrong, significant portfolio damage.

Mitigation: Diversify across deals, sponsors, markets, and property types.

Tax Benefits: The Hidden Returns

Syndications offer tax advantages that often don't get enough attention.

Depreciation

The IRS lets you depreciate real estate buildings over 27.5 years (residential) or 39 years (commercial), even though properties typically appreciate.

How it helps: Depreciation is a "paper loss" that reduces taxable income without reducing cash flow.

Example: You receive $8,000 in cash distributions. Your K-1 shows depreciation that creates a $3,000 loss. You receive cash but report negative income. Tax on that $8,000: potentially $0.

Bonus Depreciation and Cost Segregation

Cost segregation studies reclassify building components (appliances, carpeting, certain fixtures) into shorter depreciation schedules.

With bonus depreciation (currently phasing down), much of this can be depreciated immediately.

The impact: Large depreciation deductions in year one, potentially generating losses that offset other income.

1031 Exchange at Exit

If the sponsor executes a 1031 exchange at sale, gains can be deferred into a new property.

Limitation: You typically need to follow the 1031 path — your share would move to the new investment. You can't take cash and defer personally.

Passive Loss Rules

Syndication losses are typically "passive" — they can offset passive income but generally not wages or active business income (unless you qualify as a real estate professional).

Planning opportunity: Build a portfolio of passive income sources that depreciation can shelter.

How to Get Started

Step 1: Confirm You Qualify

Most syndications require accredited investor status. Verify you meet the criteria before spending time evaluating deals.

Step 2: Educate Yourself

You're doing this now. Read guides, listen to podcasts, understand the mechanics. Never invest in something you don't understand.

Step 3: Start Sourcing Deals

Where to find syndications:

- Direct from sponsors: Many syndicate directly to investors

- Online platforms: CrowdStreet, RealtyMogul, Fundrise, etc.

- Advisor networks: RIAs with private investment access

- Personal networks: Other investors often share opportunities

Step 4: Evaluate Rigorously

- Read the PPM

- Research the sponsor

- Analyze the market

- Check references

- Understand the terms

Step 5: Start Small

Your first syndication should be a learning experience, not a bet-the-farm commitment. Invest an amount you can afford to lose. Learn how the process feels.

Step 6: Diversify Over Time

One deal is concentration. Build a portfolio:

- Multiple sponsors

- Multiple markets

- Multiple property types

- Multiple vintages (years)

Common Mistakes to Avoid

Mistake 1: Chasing the Highest Projected Returns

That deal promising 25% IRR? Ask why.

Higher projected returns mean higher risk or more aggressive assumptions. Often, the projections are simply unrealistic.

Better approach: Focus on realistic projections from sponsors with track records of meeting them.

Mistake 2: Skipping the PPM

The pitch deck is marketing. The PPM is disclosure.

Everything important — fees, risks, conflicts, terms — is in the PPM. Read it.

Mistake 3: Not Checking Sponsor References

Sponsors will give you their best references. But even those conversations reveal a lot.

Ask:

- Did returns match projections?

- How was communication, especially during problems?

- Were there any surprises?

- Would you invest again?

Mistake 4: Ignoring Debt Terms

A deal with floating-rate debt and a near-term maturity has very different risk than one with fixed-rate, long-term financing.

Understand the debt. It matters.

Mistake 5: Investing Money You'll Need

Syndications are illiquid. 3-7+ years, typically.

If there's any realistic scenario where you need that money, don't invest it.

The Veracor Approach

We syndicate real estate within our Four Pillars framework — focusing on properties that serve fundamental human needs.

What We Look For

- Growing markets with diversified employment

- Value-add opportunities with clear execution paths

- Conservative underwriting with multiple margin-of-safety factors

- Aligned incentives — we co-invest alongside our investors

How We Operate

- Transparent communication, especially when challenges arise

- Quarterly reporting with clear metrics

- Accessible team for investor questions

- Long-term relationship focus, not transactional

Our Current Offerings

Our OZ Fund includes real estate development in designated Opportunity Zones, combining syndication economics with significant tax advantages.

Our VIBE Fund provides diversified exposure across our Four Pillars, including real estate positions.

Frequently Asked Questions

Q: How much should I invest in my first syndication?

Start small — an amount you can afford to lose entirely without affecting your life. $25,000-$50,000 is common for first investments. Scale up as you gain experience and comfort.

Q: How do I find good syndications?

Start with education and networking. Attend real estate investing conferences. Join investor communities. Ask other investors who they've worked with. Quality sponsors often have waitlists — relationships matter.

Q: What's the biggest risk?

Sponsor risk — the sponsor failing to execute. A great sponsor can navigate market challenges. A poor sponsor can ruin a good deal.

Q: How do taxes work?

You'll receive a K-1 annually showing your share of income, losses, deductions, and credits. Depreciation often creates paper losses despite positive cash flow. Consult a CPA familiar with real estate partnerships.

Q: Can I lose more than I invested?

As a limited partner, generally no. Your liability is limited to your investment. You won't be asked to contribute more capital (in most structures).

The Bottom Line

Real estate syndication offers something remarkable: the benefits of commercial real estate ownership — income, appreciation, tax advantages — without being a landlord.

You contribute capital. Professionals handle everything else. You collect checks and K-1s.

The trade-off is illiquidity and sponsor dependence. You can't sell when you want. Your success depends heavily on someone else's execution.

But for accredited investors with long time horizons and proper due diligence, syndications offer access to institutional-quality real estate that would otherwise be impossible to reach.

The 3 AM phone calls go to someone else. The returns come to you.

"Real estate syndication is the great equalizer. You don't need to be a real estate developer or a landlord to benefit from commercial real estate. You need capital, patience, and the ability to evaluate sponsors. That's a much more achievable bar than learning how to fix toilets."

— Kenton Gray, Founder & CEO, Veracor Group

Important Disclosures

This guide is for informational and educational purposes only and does not constitute investment, tax, or legal advice.

Real estate syndications involve significant risks including loss of principal, illiquidity, and dependence on sponsor execution. Past performance does not guarantee future results.

Most syndications are available only to accredited investors. Verify your eligibility before investing.

© 2026 Veracor Group. All rights reserved.

Last updated: January 2026