Revitalized America: Empowering Main Street's Comeback

Small and medium businesses aren’t just statistics—they’re the backbone of America, generating over 70% of new jobs and driving innovation across our economy. Yet in today’s challenging landscape, these vital enterprises face unprecedented hurdles to growth and sustainability.

The American Dream Reimagined

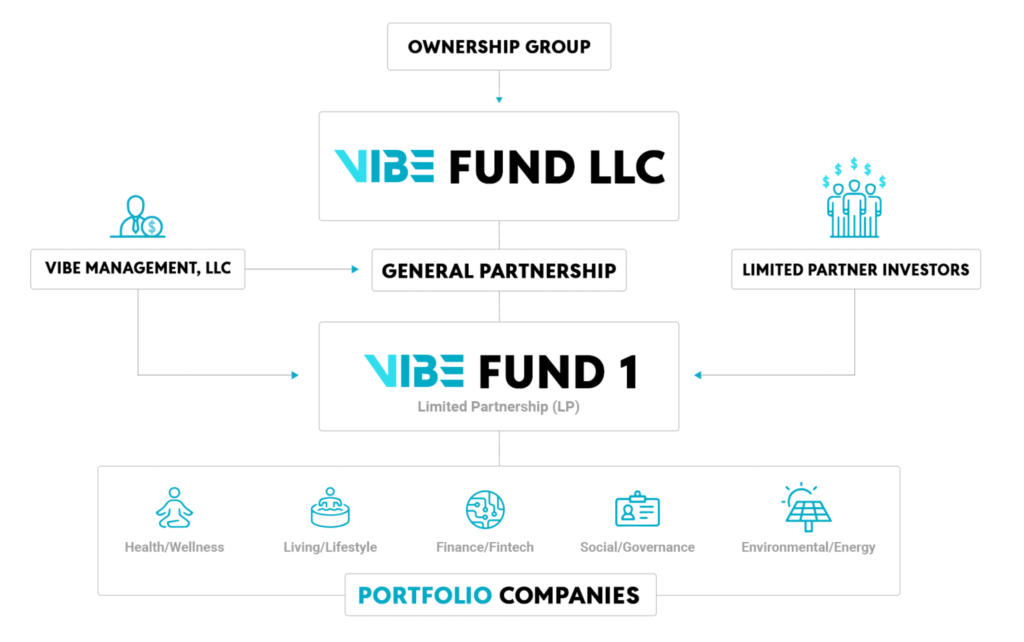

In a time when economic uncertainty has tested our resilience, the entrepreneurial spirit that built this nation remains our greatest asset. The VIBE Funds (Veracor Impact Business Equity Funds) represent a revolutionary approach to revitalizing this cornerstone of American prosperity.

Breaking Down Barriers to Capital

Our proprietary funding ecosystem seamlessly integrates the powerful tax incentives of the 2017 Tax Cuts and JOBS Act with strategic crowdfunding innovations authorized under the JOBS Act. This convergence creates a transformative capital pathway that delivers exceptional outcomes for all stakeholders:

For Investors:

Access tax-advantaged investment vehicles that generate both compelling financial returns and measurable community impact

For Entrepreneurs:

Secure the growth capital your vision demands while maintaining operational control and equity position

For Communities:

Attract sustainable investment that drives local economic revitalization, job creation, and infrastructure development

Through our VIBE Funds platform, we’re not just removing capital barriers—we’re redefining how strategic investment flows to the opportunities with the greatest potential for both financial and social returns.

The VIBE Fund Advantage

In today’s complex economic landscape, conventional funding channels continue to overlook high-potential ventures that drive genuine innovation and community prosperity. The VIBE Funds platform transforms this paradigm through a sophisticated capital formation strategy that leverages key SEC exemptions—Regulation CF, Regulation D 506(c), and Regulation A+—to create frictionless pathways between capital and opportunity.

Our strategic approach unlocks previously inaccessible funding channels for growth-focused enterprises while providing capital partners with unique entry points to value-creation opportunities at their optimal stage of development. This dual-benefit model ensures that promising ventures secure the resources they need while capital providers access diversified investment vehicles structured for both compliance efficiency and performance potential.

By fundamentally reengineering how capital flows to innovation, VIBE Funds isn’t just addressing market gaps—it’s creating an entirely new ecosystem where aligned interests accelerate sustainable growth and exceptional returns.

Join the Movement

We’re not just funding businesses—we’re investing in America’s future. By connecting capital with innovation, we’re helping rebuild communities, create meaningful employment, and restore the promise of opportunity for all.

The next chapter of American prosperity starts with strengthening the businesses that strengthen our communities. Together, through the VIBE Funds, we can ensure that the pursuit of happiness remains within reach for every entrepreneur with vision and determination.

The time for action is now.

VERACOR IMPACT BUSINESS EQUITY FUNDS

THE VIBE OPPORTUNITY

Strategic Innovation in Impact Investing

The Veracor Impact Business Equity Management Team has pioneered a transformative approach to impact investing that stands apart in today’s market. Our distinctive methodology creates a powerful intersection of social benefit and strategic returns by targeting high-potential U.S. companies in key growth sectors.

This approach resonates strongly with three primary investor segments:

- Family Impact Offices seeking investments that align financial goals with meaningful social outcomes

- High Net-Worth Individuals requiring sophisticated capital gains deferral solutions while supporting economic development

- Global Accredited Investors looking to participate in America’s most promising emerging companies with both purpose and profit potential

By strategically aligning investment opportunities with tangible community impact, we’ve created a framework that doesn’t just attract capital—it directs it where it can generate the greatest combined financial and social returns.

Our targeted focus on U.S. growth sectors positions Veracor at the forefront of the next generation of impact investing: one that proves purpose and profit are not competing priorities, but complementary forces for sustainable prosperity.

ENRICHED COMMUNITIES

The backbone of the economy

Download Our Introductory

Opportunity Zone Guide

We will keep you updated regularly, but not obnoxiously. Opt out at any time